|

| RAZA |

On 19 March 2013, Sotheby’s is honored to present the Amaya Collection - the first international Evening Sale of Indian Art and the first single-owner sale in this category to be held at Sotheby’s in more than a decade. Consigned by esteemed collector and author, Amrita Jhaveri, the collection comprises important Modern & Contemporary Indian Art produced during the second half of the 20th Century through to the early 21st.

The sale offers some fine examples from the oeuvres of key artists, including highly sought-after and important works by 20th Century Modernist Masters Maqbool Fida Husain, Tyeb Mehta, Francis Newton Souza, Sayed Haider Raza, and Vasudeo Gaitonde, many of which have been extensively published and exhibited internationally. The auction of 43 lots is estimated at approximately $5 - 7 million, and works will be exhibited in New Delhi, London and New York in advance of the sale. Proceeds from the sale will underwrite a project space and lecture room at Khoj International Artists’ Association in New Delhi. Amrita Jhaveri is also supporting museum initiatives in the collecting area of South Asian art by donating a work by sculptor Mrinalini Mukherjee to the Tate Modern.

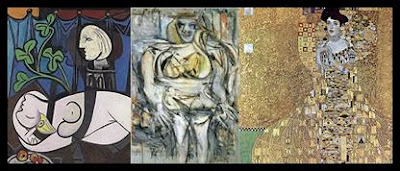

The sale is led by Tyeb Mehta’s Untitled (est. $800,000/1.2 million, right) from 1982, produced during an important period in the artist’s career. Painted three years before the famous Santiniketan Triptych, the current work possesses a number of key parallels. In both works he used an unusually muted palette, and the androgynous figures are placed against a distinctive pastel blue ground. Mehta spent the early 1960s in London where he was exposed to the style of Francis Bacon, which greatly influenced his early works

|

| Tyeb Mehta - Untitled |

A further highlight is Rajasthan I (est. $600,000/800,000, top of page 1), a resplendent work by Sayed Haider Raza from the 1980s which brings together his influences from France and India to represent an ultimate depiction of nature. This painting is from a period that represents his transgression towards total abstraction and is influenced by the Indian miniature tradition not just in composition but also in palette.

The 1962 painting, Untitled (est. $600,000/800,000, left) by Vasudeo S. Gaitonde, one of India’s most important modern abstract painters, was one of few canvases produced during his lifetime. His work was greatly influenced by the color techniques of Indian miniatures, the study of ancient scripts and Japanese Zen philosophy.

|

| Puppet Dancers, MF Hussain |

Painted in 1963, The Puppet Dancers (est. $200,000/300,000,) represents Maqbool Fida Husain’s fascination with toys, a theme that he developed during the 1940s and 1950s. While working at the Fantasy furniture company in Bombay in the early 1940s to make ends meet, he began to design and paint children’s toys, which he cut from plywood and hand painted. Although Husain only produced the toys for a short period, his interest in the subject lived on. This composition is very similar to a 1950s preparatory sketch he produced for one of his plywood toys. A distinctive set of characters that he employed throughout his career are also seen in this piece: faceless woman, equine figure, tribhanga nude and mustachioed warrior

Additional Collection Highlights

Francis Newton Souza

|

| The Cruxifixion, Souza |

The Crucifixion - Estimate $200/300,000

The Crucifixion is a powerful painting that represents Souza’s fascination with religion that continued throughout his career. This painting is one of his largest and most evocative portrayals of the subject.

Bhupen Khakhar

Satsang - Estimate $180/250,000

In Satsang, Khakar depicts a Hindu gathering with a group of male figures paying their respects. He has placed himself within the narrative, both seated amongst the seated figures to the right and at the rear of the primary standing figure in the foreground. Highly influenced by his time in London and his friendship with David Hockney and Sir Howard Hodgkin, Khakar combines the lush evocative scenery with hues relating to folk traditions.

Maqbool Fida Husain

The Horse that Looked Back - Estimate $100,000/150,000

Throughout his career, Husain has repeatedly represented the horse in his works, and they are depicted as wild symbols of power and raw energy. His interest in horses first began in his youth through religious stories relayed to him by his grandfather depicting the animal as both heroic and tragic. This 1963 composition was exhibited at the 2006 Asia House exhibition, M. F. Husain: Early Masterpieces 1950s – 70s.

Arpita Singh

Untitled - Estimate $80,000/120,000

Arpita Singh, one of the most important mid-generation female artists, often portrays the role of the female within contemporary Indian society in her humorous and disturbing paintings. Her subjects are drawn from family, friends, neighbors and everyday objects. Singh was greatly influenced by Marc Chagall, not just in palette and composition, but also in imagery.

Ram Kumar

Untitled - Estimate $60,000/80,000

Untitled from 1959 belongs to Ram Kumar’s early figurative phase, which not only reflects his disillusionment with the monotony and anonymity of urban existence, but is also part of a larger commentary on the unrealized promises of Independence which had held hope for a better life for millions of Indians. The figures in these paintings are reminiscent of the forlorn characters he portrays in his novel, Ghar Bane Ghar Toote, which depict the isolated and despairing urbanites of India who feel constrained by the city itself, its vast faceless population and the poverty and decay that surround them.

Jogen Chowdhury

Ganesh with Crown Estimate - $40,000/60,000

Chowdhury’s subjects are usually rendered against a black background, their fluid contours tightened with cross- hatching and heightened with touches of color. This 1979 work is part of the Ganesha series that he produced during the end of his tenureship where he plays on the popular characterization of the elephant god. Ganesh with Crown was formerly in the Chester and Davida Herwitz collection and was exhibited at Museum of Modern Art, Oxford, in 1982