Would you pay more than $100 million for an artwork? Well most of us would not, the primary reason being that, most of us would not be able to afford it. However, it is quite intriguing to learn what goes through the mind of people who spend millions on an artwork.

Let us look at it this way, for a Multibillionaire spending $100 million is not a big deal, its less than 10% of the person’s total wealth. Most probably, such people have already exhausted all the different investment avenues and have turned to art. There are corporate houses that acquire art as an investment that also helps in creating a pleasant work atmosphere. Art, although a (very) long investment, can yield excellent returns, if you have the patience.

Below given are some of the unbelievable and surreal prices paid for art in the 21st century:

• Andy Warhol’s ‘No.5, 1948’ claimed the highest value for a painting auctioned at $140 million in 2006

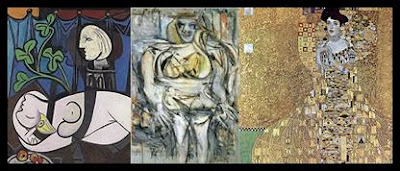

• Gustav Klimt’s ‘Portrait of Adele Bloch-Bauer I’ sold for $135 million in the year 2006

• Edvard Munch’s ‘The Scream’ sold for $119.9 million at Sotheby’s New York in May 2011.

• Pablo Picasso’s ‘Nude, Green Leaves and Bust’ sold for $106.5 million Christie’s in New York in 2010

• Picasso’s ‘Boy with a Pipe’ raised $104.2 million at auction in 2004

• Albert Giacometti’s ‘L’Homme Qui Marche’ reached $102.7 million when it was sold in 2010 (Sculpture)

• Andy Warhol’s silk screen printing of Elvis, called ‘Eight Elvises’ was auctioned for $100 million in 2009

If you noticed, I have limited the paintings to the minimum price of $100 million. There are many more paintings from the masters in the range of $50-$100 million dollars.

Imagine this, most of us fuss over a painting that costs $10,000. Life is not fair, but I guess most people need to settle for paintings in the affordable ranges. Some of these can be a very good investment. Important tip, in this category the investors better like what they buy, as its going to be with them for a long long time.

For the ones who like it, it could be a pleasurable hobby and investment. The art market will grow once we are over the recession cliff. So my advice is to buy contemporary art while the prices are low.

Happy Art Investing….in 2013

Interesting Links:

List of the world’s most expensive paintings